Futures: MESZ2025

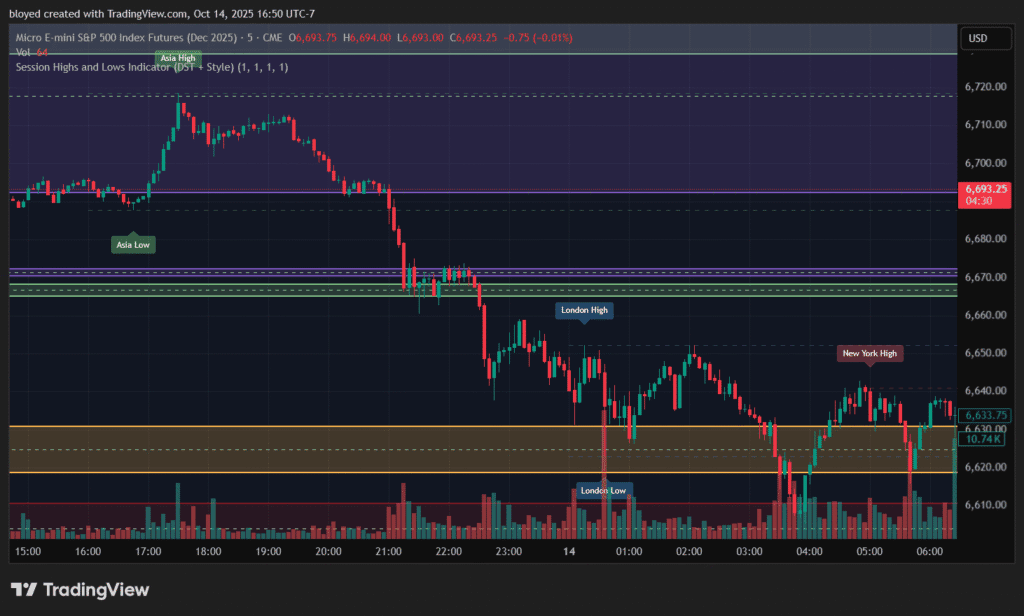

Pre-Market/London Session and Asia Session:

All signs pointed to a dump as pre-market was down about 1% before NYC Open. This was following news of China’s negative comments towards the U.S. following Trump’s Truth Social posts. Market tried to breach a Weekly FVG created last month (in red) and failed twice before closing.

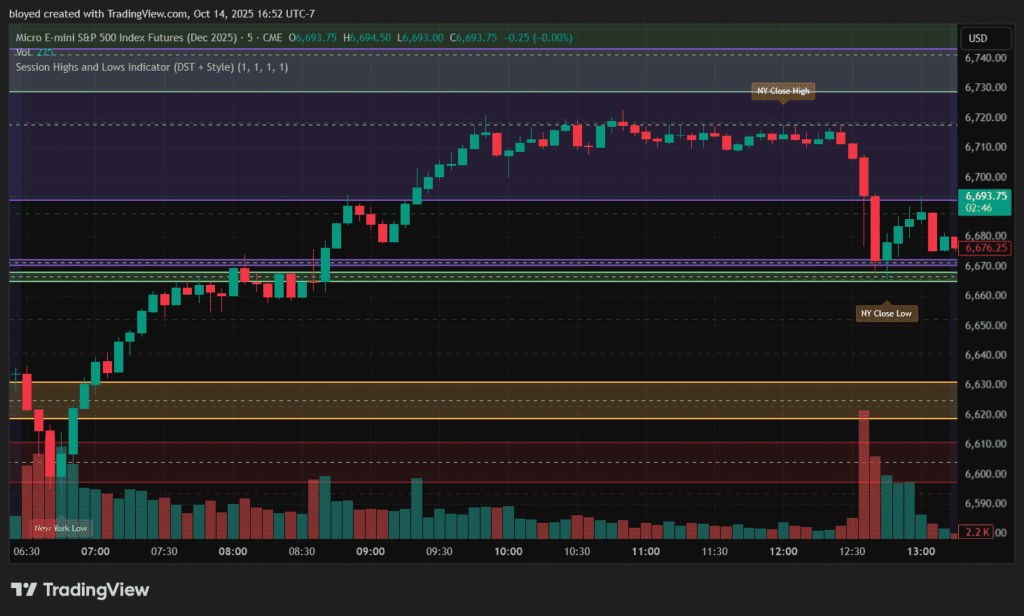

New York Session:

NYC opened and within about the first 30min saw a massive pump. You can see that it looks pretty clear that it was bouncing off of that red zone (Weekly Fair Value Gap) and that’s all it needed to break the daily fair value gap (orange zone), 4 hour (green zone), and 1 hour fair value gaps (purple zone). This led to a near trend day where it continued to pump until struggling with the middle of a 1HR FVG.

At around 12:30PM PDT, Trump announced on social media more threats against China, which led the market to dip further until finding resistance at a 4HR FVG.

Key Takeaways:

- Weekly FVG is still extremely strong and consistently proves to be a bullish zone for the market. BULLISH

- Despite reignited “trade war” tensions, the market seems to take any chance

- Any mention of “trade war” threats by Trump or Xi, still have short-term sway over the market, but has been able to recover

Events to take into consideration

- Trump and Xi will still be meeting to discuss trade in late October